Enterprise ESG, Purpose-Built for Banks and Insurers.

A pre-built accelerator designed to support Double Materiality, Financed Emissions, and ESG reporting — tailored to the regulatory and operating needs of banks and insurers.

The Challenges We Solve.

Banks and insurers face unique challenges when delivering ESG, from interpreting evolving regulations to coordinating SME inputs and ensuring consistent, auditable data across frameworks.

Understanding and Industrialising Double Materiality

The ESG process begins with the Double Materiality Assessment — a strategic exercise that defines what matters most across financial and impact dimensions.

Yet many firms lack a structured, repeatable way to conduct and update this assessment across business lines and legal entities.

Ensuring data accuracy, validation and auditability

Reporting emissions, exposures, and sustainability performance depends on data that can be trusted — internally and externally.

Inconsistent definitions, duplicated calculations, and weak lineage controls put firms at risk during audits and reviews.

Automating disclosures across multiple frameworks

Banks and insurers must report across overlapping frameworks, each with different formats and focal points.

Without a structured workflow and standardised content, reporting becomes repetitive, time-consuming, and expensive to maintain.

Integrating ESG targets into strategic and financial planning

Delivering against net zero and sustainability goals requires more than reporting.

Institutions need to link ESG to business strategy, capital allocation, and integrated planning — including the industrialisation of avoided emissions metrics.

Interpreting regulatory expectations and benchmarking ESG performance

CSRD, Pillar 3, and the EU Taxonomy introduce detailed requirements — but much is still open to interpretation, particularly for diversified groups and cross-border entities.

For insurers, sustainability disclosures under Solvency II, SFDR, and EIOPA guidelines add further complexity. Firms need to interpret these frameworks and track how their ESG ratings, targets, and disclosures compare across peers, sectors, and market expectations.

Compliance costs are increasing when reducing costs is the priority

As ESG reporting requirements grow in scope and frequency, firms are spending more on consulting, manual workarounds, and rework across reporting cycles.

Few have a scalable model to contain these costs. With pressures to cut costs, internal and external reporting processes must be transformed to reduce operational effort and duplication.

Our Approach

An ESG Delivery Framework for Banks and Insurers

Our accelerator includes a systematised Double Materiality Assessment, pre-built data models, embedded regulatory frameworks (CSRD, EU Taxonomy, and sector-specific guidance such as Pillar 3 and EIOPA), and AI-assisted content generation — designed to streamline ESG delivery and reduce cost across banks and insurers.

A Systematised Double Materiality Assessment

A repeatable approach to identifying ESG priorities across financial and impact dimensions — with structured inputs, defined ownership, and full traceability. Supports ongoing updates as materiality evolves.

Manage Scope 1, 2 and 3 Emissions

Support for emissions data capture, calculation, and reporting — including Scope 3 financed emissions, with appropriate proxies and audit-ready logic. Enables consistent and defensible disclosures across multiple frameworks.

Pre-Built Framework Structures and Disclosure Logic

Regulatory content and reporting structures aligned with CSRD, EU Taxonomy, Pillar 3, and EIOPA guidance — reducing reliance on external interpretation. Supports structured disclosures, traceability, and repeatable reporting cycles.

.

Cross-Framework Data Consistency

Shared definitions, controlled hierarchies, and data validation built in — allowing ESG metrics to be reused across frameworks without duplication or rework. Ensures consistency between disclosures, planning, and internal reporting.

Workflow and Governance Across the ESG Process

End-to-end visibility from SME input through to review and sign-off. Enables version control, validation steps, and audit trails — reducing delivery risk and supporting internal controls.

AI-Assisted Content Generation and Review

Agentic AI and retrieval-augmented generation (RAG) can support narrative drafting, evidence capture, and peer comparison. This reduces manual effort and accelerates the production of high-quality disclosures.

Solution Overview

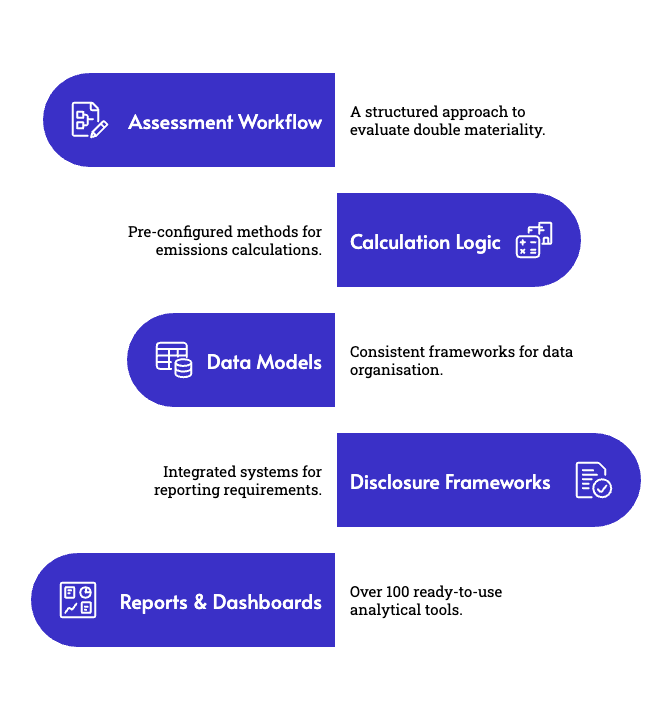

Our solution provides a structured, end-to-end framework to support ESG delivery across strategy, data, calculation, and reporting.

The accelerator includes a systematised Double Materiality Assessment workflow, pre-configured calculation logic for Scope 1, 2, and 3 emissions — including financed emissions at the contract and account balance level — consistent data models, embedded disclosure frameworks, and 100+ ready-to-use reports and dashboards. This enables confident, repeatable reporting across CSRD, EU Taxonomy, Pillar 3, and EIOPA guidelines, while unlocking deeper insights into climate finance performance and risk exposure.

Structured Double Materiality Assessment

A systemised approach to identifying and reviewing ESG priorities across impact and financial dimensions. The workflow supports stakeholder input, review cycles, and traceable outputs — enabling a consistent, defensible assessment process that can be repeated across business lines and entities.

Pre-Configured Emissions Calculations

Built-in logic for Scope 1, 2, and 3 emissions — including financed emissions calculated at the contract and account balance level, using appropriate proxy and allocation methods. Designed to support auditability and alignment with regulatory expectations while allowing institutions to scale and refine their calculation processes as data quality and granularity improve.

Financed Emissions Planning and Target Modelling

The solution supports forward-looking modelling of financed emissions pathways at the contract and account balance grain — enabling precise tracking of climate targets, evaluation of avoided emissions, and integration into business and capital planning. This level of granularity unlocks deeper portfolio insights and improves the traceability of ESG outcomes across banking and insurance books.

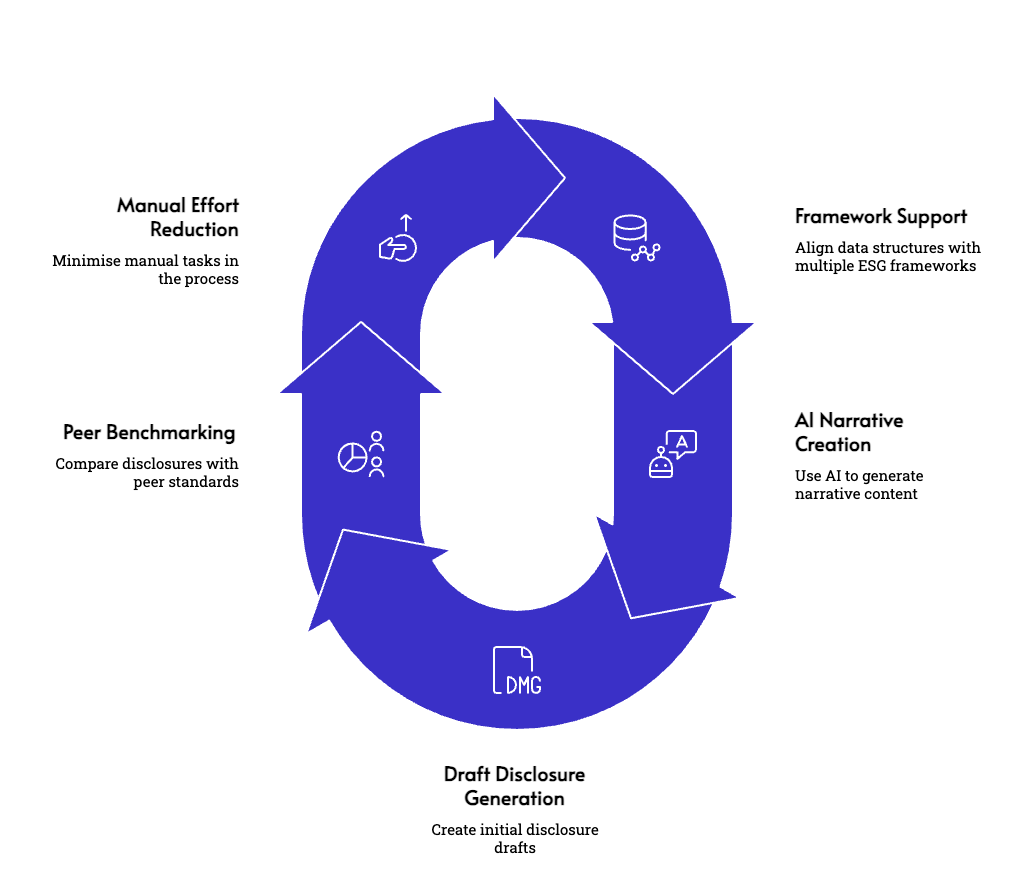

Multi-Framework Disclosure and AI-Assisted Reporting

Support for reporting across CSRD, EU Taxonomy, Pillar 3 and EIOPA, with data structures, mappings and content tailored to each framework. Generative AI can be used to accelerate narrative creation, generate draft disclosures, and benchmark responses against peers — reducing manual effort and review time.

A Complete ESG Delivery Framework

Together, these capabilities provide a unified ESG delivery environment tailored to the operating model of banks and insurers. From strategic assessments to granular calculations and regulated disclosures, the accelerator brings structure, governance, and control to every step of the ESG process. Institutions can eliminate fragmented workflows, reduce reliance on external consulting, and scale reporting across entities, frameworks, and reporting cycles — all within a single, auditable platform.

Client Impact

We partner with leading banks to solve complex challenges and deliver measurable results. Our work spans strategic modelling, regulatory transformation, and finance systems innovation — always grounded in tangible business outcomes.

Join Us in the Innovation Lab

Join Us in the Innovation Lab

We invite you to join a focused Innovation Lab — a collaborative session designed to help your team define or refine the core problem statement, align on a clear North Star vision, and explore the solution in action.

Let's have the right conversation.

.png?width=960&height=540&name=ESG%20Recipe%20(Blurred).png)