Transforming FP&A in Retail Banking with Oracle EPM and Generative AI: A Strategic Playbook.

In the fast-paced world of retail banking, the Financial Planning & Analysis (FP&A) function has evolved from a back-office operation focused on...

6 min read

Jordan Johnston

Oct 28, 2025 12:42:47 PM

Introduction

AI is already reshaping finance — from forecasting and reconciliation to narrative reporting. The conversation has moved beyond exploration. The challenge now is consistency: how to make intelligence dependable, governed and auditable across a landscape that spans multiple clouds, data platforms and regulatory regimes.

A decade of investment in cloud and data has built powerful but parallel ecosystems across finance and risk — each optimised for its own priorities but rarely connected end to end. The opportunity now lies not in replacing them, but in activating what already exists — extending those same data foundations to host AI models and decision frameworks that connect information, improve responsiveness and strengthen control.

The next phase for finance isn’t about starting over, but about realising more from the investments already made — bringing intelligence to the data, systems and controls that exist today, and allowing insight to flow through them with the same consistency, governance and assurance that finance has always demanded.

The reality for finance leaders today

A decade of investment in cloud and analytics has expanded the reach of finance — but not yet the confidence with which it can act. Control frameworks are strong, but the connections between them are weak. The landscape performs, but not as one.

Critical data remains spread across multiple platforms and jurisdictions, each built for its own purpose: analytical warehouses for performance reporting, capital and liquidity engines for exposure management, and regulatory platforms for compliance. Each performs well in isolation, yet together they fragment lineage, duplicate effort and slow decision-making. Information moves, but it rarely converges into a single, governed view that leadership can trust in the moment.

That fragmentation shows up in ways every senior finance executive recognises:

The constraint is not capability but configuration. Finance holds vast reserves of data, mature systems and proven governance disciplines — yet these assets were designed for reporting, not for continuous intelligence. They remain distributed across silos built for control rather than connection. The opportunity now is to link them into a single, governed fabric where capital, liquidity and performance insight draw from the same truth, allowing decisions to move with the speed and assurance the business demands.

What a unified architecture makes possible

Finance’s challenge is no longer recognising the barriers — it is removing them at scale. Fragmented data, delayed reconciliations and limited traceability are well understood; what is new is the ability to address them within a single, governed architecture rather than through another round of system replacement.

Years of investment have created sophisticated but disconnected environments. The opportunity now is to convert that capability into cohesion — ensuring data, models and controls operate as one system. The advantage will come not from more technology, but from how effectively existing systems interpret shared data, act on common intelligence and sustain confidence in every result.

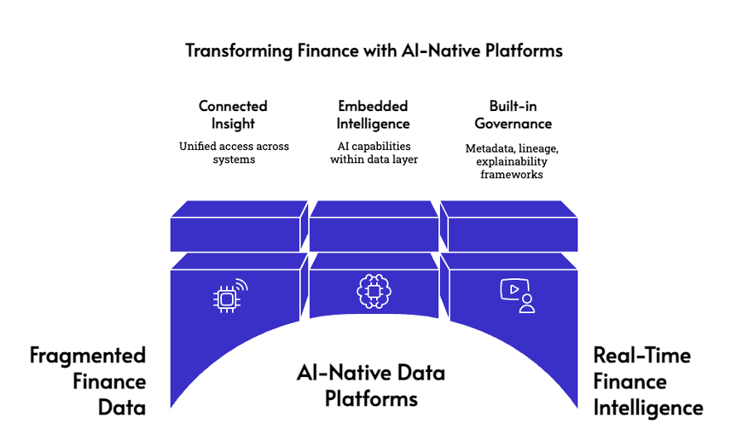

AI-native, autonomous data platforms make that integration practical. Built around governance and interoperability, they introduce three capabilities that move finance from interpreting results after the fact to steering performance as it happens.

Together, these capabilities turn architecture into advantage. Finance no longer trades speed for assurance; it gains both — real-time intelligence, governed and explainable by design.

For banks and insurers, this represents a step-change in capability — the capacity to act on live, governed data with the same rigour and confidence that define financial control.

From information to impact: what enablement looks like in practice

For finance leaders, the impact of AI-native architecture is measured not in data volumes or query speed, but in confidence — the confidence to act early, align across functions, and stand behind decisions that are explainable under scrutiny.

As finance and risk functions begin to operate on a shared intelligence layer, the organisation gains something it has long sought: a single, governed view of performance that moves as fast as the business itself. When information flows with control, finance can move from recording outcomes to shaping them.

Continuous performance insight

Finance leaders can interpret the enterprise as a living system. Real-time connections between finance, risk and operational data reveal how shocks propagate — from claims ratios to liquidity positions. This turns monthly retrospection into continuous situational awareness.

Predictive control across finance and risk

Scenario modelling, loss forecasting and provisioning can all run on shared, governed data. AI agents can project outcomes and test sensitivities within minutes, tightening the loop between risk appetite, capital allocation and strategic planning.

Liquidity and working-capital precision

Instead of static treasury views, AI-driven analysis across payables, receivables and credit exposures allows CFOs to anticipate pressure points and release trapped cash earlier — improving resilience without increasing cost of control.

Assurance that scales with automation

Auditability no longer sits outside the process. Every model output, forecast and journal can be traced through lineage and explainability metadata, reducing audit queries and strengthening confidence across the first and second lines of defence.

Shorter, safer planning cycles

Access to live, governed data compresses the time between close and forecast. Teams can iterate faster, test assumptions continuously and adjust plans knowing that governance keeps pace.

The architecture behind it

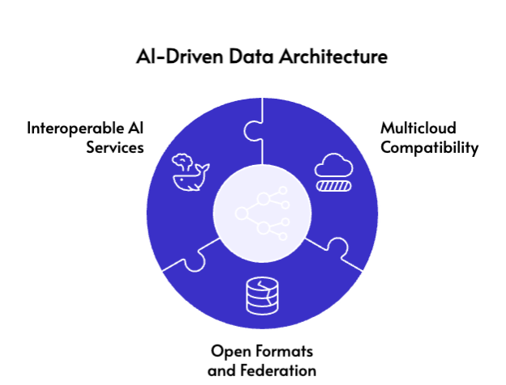

The architecture that enables this depends not on uniformity but interoperability — making multi-cloud, multi-domain data estates work as one. AI-native autonomous architectures make that possible through:

This is architectural enablement in practice: a federated yet unified data landscape — flexible in design, consistent in logic, and capable of supporting AI-driven finance at enterprise scale.

From modernisation to measurable impact

After years of investment in modern systems and cloud platforms, most finance organisations now face a different question: how effectively do those environments perform as a single decision platform? The next phase of progress lies in using what already exists — not to modernise further, but to deliver measurable improvements in speed, confidence and control.

In practice, this means reframing the markers of progress:

The value of AI-native architecture will be seen not in new systems, but in the consistency and confidence of the decisions it enables. When information, governance and automation operate as one, finance gains the precision to act — not just to report.

From compliance to confidence

For finance leaders, the real test of AI will be whether assurance can scale as automation expands. Sustainable progress depends on control being built into the data fabric itself — not imposed as a layer of oversight once the process is complete.

In an AI-native architecture, data and models carry their own context. Every transformation, forecast and adjustment can be traced, explained and validated from source to disclosure. Assurance becomes continuous — part of how the system operates, not a separate review stage.

This integration changes how confidence is created. It reduces audit effort, shortens review cycles and provides regulators with transparent lineage from model to metric. For boards, it restores clarity around how financial outcomes are produced and governed.

The result is a more durable form of trust: automation moves faster, yet every decision remains explainable under scrutiny. Control doesn’t constrain innovation — it makes innovation dependable.

Revvence point of view

The gap between experimentation and enterprise-scale adoption is widening. Many finance teams have embedded AI into forecasting, reconciliation and risk processes, yet integration with the governed systems that support financial control remains uneven. The challenge is not adoption but achieving consistency and assurance at scale.

At Revvence, we focus on helping CFOs, finance and risk leaders turn modern data and AI capabilities into tangible performance, control and insight. Our team combines deep client-side finance experience, Big Four transformation heritage and Oracle delivery expertise — allowing us to design solutions that are both technically credible and operationally proven.

Our approach is practical and architecture-led:

Finance-aligned data architecture. We design governed finance data fabrics that strengthen existing Oracle investments while integrating seamlessly with other enterprise and cloud platforms. The goal is coherence — a single architectural model that unites control, data and intelligence.

Embedded governance design. We align finance data, models and AI services around a single lineage and control framework so every automated decision remains explainable and auditable.

AI-ready control backbone. We integrate forecasting, reconciliation and variance logic within the data layer itself — enabling automation that operates inside governed boundaries, not outside them.

Outcome-led delivery. We measure success through tangible results: faster close cycles, lower audit effort, improved forecasting precision and stronger confidence in reported outcomes.

Finance functions that connect governance and intelligence at the architectural level gain a lasting advantage: the ability to move faster without sacrificing control. This is where Revvence operates — designing the architecture, controls and operating models that turn finance systems into a lasting source of confidence and intelligent decision-making.

In the fast-paced world of retail banking, the Financial Planning & Analysis (FP&A) function has evolved from a back-office operation focused on...

Global banks and financial services businesses are considering the role of Generative AI (GenAI) in the finance function. We believe that using a...

Introduction